A health savings account, or HSA, is a type of saving account that allows you to set aside tax-deferred money for healthcare expenses. It’s essentially a retirement plan but for healthcare purposes. HSA’s can be a great option because you are in full control of the money in your account, and since it’s tax-deferred, you’ll end up paying less in taxes every year. Who doesn’t love that? However, not just anyone can open up a health savings account.

Qualifying for an HSA

To qualify for an HSA, you need to be actively participating in a qualified high-deductible health insurance plan, typically with no other health coverage. In a high deductible plan, as the name implies, the yearly deductible is more than a typical health plan. Once those deductibles are paid out of pocket, you can be reimbursed for what you’ve set aside in the HSA.

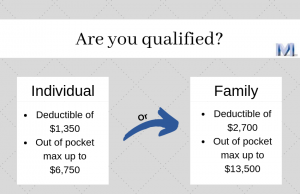

For 2019, the IRS considers the following a qualifying plan for an HSA:

- Individual coverage with a deductible of at least $1,350 and an out-of-pocket maximum up to $6,750.

- Family coverage with a deductible of at least $2,700 and an out-of-pocket maximum up to $13,500.

- People who receive Medicare who also have a high-deductible plan are not eligible.

Advantages of a health savings account

There are several advantages to health savings accounts:

- You’re in full control of the money in your account so you can decide how much money to set aside

- You can go to multiple doctors to find the best quality care that works with your budget

- Your employer can also contribute to your account

- Your HSA is yours to keep, regardless of your employer

- Any money left over at the end of the year rolls over and stays in your account

- You don’t have to pay taxes on the money that goes into your account

- After age 65, you can use the money in your account for any reason at any time (taxes will be deducted if not used for healthcare expenses).

What’s the difference between an HSA and FSA?

The main difference between an HSA and FSA account is that generally, for an FSA, you have to spend all of the money in your account by the end of each year. There may be a $500 carryover limit with an FSA, but if you have over $500 in your account, you’re out that extra money altogether.

Another difference is that an HSA goes with you from job to job or when you retire. You can’t take money from a flexible spending account with you if you change jobs or retire- you’ll simply be out of money.

Also, you typically can’t have both an HSA and FSA at the same time, so it’s important to know the options you have.

2019 contribution limits

For 2019, qualified individuals can contribute as much as $3,500 and families can contribute $7,000. If you are over 50, you have a “catch up” allowance and can contribute an additional $1,000 per year along with your applicable limit.

It’s important to note that limits change annually and tend to be adjusted for inflation. Also, if your employer contributes toward your HSA, that will count toward your total annual limit.

Take advantage of an HSA

At the end of the day, if you have the ability to contribute to a health savings account, you should take advantage of the opportunity. An HSA is a smart way to save for future medical expenses if anything catastrophic should occur. It is also an excellent addition to your existing retirement plan.